Killing the Golden Goose — The 1900% Beer Tax Hike would be a knife in the heart of Oregon’s Craft Beer Industry.

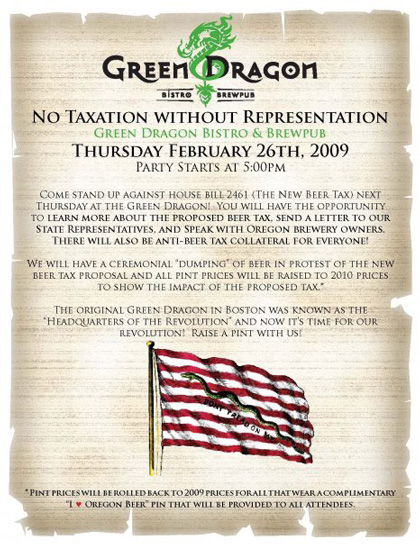

I recently made a trip up to Portland to attend the “No New Oregon Beer Tax Rally†at the Green Dragon. What I found out about the tax hike proposed by Oregon House Bill 2461 shocked me and left me worried for the future of Oregon’s world famous craft brewing industry. HB 2461 was sponsored by five Oregon Legislatures (Representative CANNON, Senators DINGFELDER and MORRISETTE; Representative DEMBROW, and Senator ROSENBAUM) who will be referred to from here on as the “Fab-5†for purposes of brevity.

I wonder if the Fab-5 ever heard the old adage “Every solution presents a whole new set of problems� I’m don’t believe the Fab-5 really bothered to look at the problems their “solution†for funding additional state mental health, drug, and alcohol treatment programs would create when they sponsored HB 2461 which proposes a 1900% increase in the barrel tax on beer in Oregon. That’s not a typo! They would like to raise the tax on a barrel of beer from $2.60 per barrel to $52.21 which is a 1900% increase.

They downplay the bill as a reasonable and minor tax increase needed because Oregon’s beer tax, ranked 47th in the nation, is too low. Huh? Let me get this straight. Your main argument for raising the tax I pay on a pint of beer 1900% is “Well the tax hasn’t been raised in a long time.†Not because it is right or fair, or because there is a demonstrable cause and effect between beer and these programs they seek to fund with this tax, but simply because the tax hasn’t been raised since 1977.

Sorry that’s not a good enough reason to damage the states beer industry and the Oregon microbrewers that have grown into a vibrant Oregon success story that creates roughly 15,000 direct and indirect beer industry related jobs in this state. Not only does Oregon’s craft beer fill our pint glasses with world-class artisanal brew, it has created a “beer tourism†draw that many peripheral Oregon businesses’ benefit from.

You’re probably wondering “Since this tax is levied on all beer consumed in Oregon, why does it impact our craft brewing industry more than other states selling their beer here?†Though this tax is on all beer consumed in the state, Oregon Craft Breweries biggest market is Oregon. In 2008, 36% of the beer made by Oregon Craft Breweries was sold in Oregon. Out of all the beer consumed in the state, 11.4% was Oregon Craft Beer. This means our craft brewing industry, as a group, will be impacted most by the proposed 1900% tax increase.

If the Fab-5 insists on looking back to 1977, let’s take a look at how many barrels of beer were being consumed in Oregon then. Numbers are hard to come by but I did discover a study on Oregon’s bottle bill that puts the consumption in 1973 at roughly 1.5 million barrels (By the way, Blitz-Weinhard was the only brewery in Oregon back then). Using that as a starting point, the taxes generated by those sales were approximately $3.9 million. Last year Oregonians consumed 2.72 million barrels of beer, resulting in over $7 million in revenue from the current tax. Whereas the Fab-5 keeps waving the “no increase since 1977†flag, they seem to have completely missed the fact that tax revenues from beer have increased about 56% in that same time-span.

Of course that doesn’t add in the revenues they reap from having close to 90 breweries here in the state, providing jobs and paying business, property, and income taxes. They wouldn’t want to muddy the water with a bunch of facts that don’t support their position.

The other major point pushed by HB 2461 is these additional taxes are needed to pay for additional state mental health, drug, and alcohol treatment programs. Out of $155.8 million in net revenue from alcohol excise taxes in 2008 only $7.9 million was targeted to those programs. I do not dispute the fact that these programs are important, I do however wonder why these important programs are being so woefully underfunded and why Oregon’s beer drinkers are expected to shoulder the entire burden. Oh, and one other thing…Um…this may seem like a silly question, but that $155.8 million is NET revenue not gross revenue, could you tell me exactly where the other $147.9 million dollars you collected went?

Passage of HB 2461 would add another $135 million in Oregon alcohol excise tax revenue to the state coffers, effectively doubling Oregon alcohol tax revenues on the back of beer alone whose contribution would be $142 million at current consumption levels. Of course that won’t be the cost to the Oregon consumer, oh no. The Fab-5 keeps saying the new tax will only add an additional 15 cents per 12 oz. onto the cost of beer. It’s a good thing they’re in government because they’d never survive in business. Anyone who has been in business is familiar with the concept of acceptable profit margins a business needs to maintain to stay in business. If they aren’t they probably are no longer in business. (They’re most likely now working in government) Maintaining profitability margins through the system for all the players involved from brewery to glass puts the actual impact of that 15 cent increase at the wholesale level at a $1.50 per pint when it finally reaches the consumer. The overall impact on Oregon beer drinkers will be about $315 million at current consumption levels.

This will be a boon for our border states who will see a dramatic increase in sales to Oregonians who will jump state lines to purchase their beer in bulk, or patronize pubs where they can purchase beer at a much lower price (even Oregon beer).

Those who follow the beer industry are aware the last two years have been extremely difficult due to shortages and huge price increases in the costs of raw materials. Those price increases have already negatively impacted the profit margin on each barrel of beer nationwide and resulted in increases in beer prices. What a great time to slap a hefty increase on the industry.

Was the Fab-5 paying attention during the recent gas price crisis? It’s simple economics. This is how it worked, the more the consumer was charged for gas, the less they purchased. The less they purchased, the less tax per gallon was collected for the Oregon coffers. What did this lead to? A state government proposal to raise the gas tax. If the HB 2461 tax increase impacts the industry in the same way, and many believe it will, then it will result in reduced beer, and more importantly to our states craft beer industry, drastically reduced craft beer consumption. What will the state do when this tax doesn’t achieve its goals because of reduced consumption? Hmmmm, history indicates they’ll probably vote to raise it again to make up the deficit. This will create a hostile tax environment for craft breweries and spell the beginning of the end for growth of the craft brewing industry in Oregon.

A timely article in the March 4th Guardian discusses the woeful impact of 2008’s 18% beer tax increase in the UK. To date “A record 2,000 British pubs have closed with the loss of 20,000 jobs since the chancellor, Alistair Darling, increased beer tax in the 2008 budget.” “A separate forecast by Oxford Economics that 75,000 more jobs in the drinks industry are at risk.”

The proposed 1900% increase HB 2461 mandates would make Oregon’s Beer Tax the highest in the good old USA. 37% higher than the current number one state, Alaska. (Yea for us, we’ll be #1!) Are Oregonians so prosperous the state government leeches need to bleed us of our excess income? Well let’s evaluate how Oregon ranks compared the other states.

The first category is, of course, number of craft breweries. We are rightly proud of the number and quality of craft breweries in our state but we are not number one. We are in the top 5, and 6 of the country’s top 50 craft breweries are here in Oregon, but this year Colorado opened its 101st brewery, taking the number one spot. Oregon has roughly 88 craft breweries. Except for a select few, most of the craft brewery owners I know aren’t making much more than a living wage from their business. A common adage in the craft beer industry is “If you’re getting into brewing beer to get rich you picked the wrong business.”

So what other categories does Oregon rank so high? There must be something that flips a switch in a lawmaker’s head to go down this road to ruin. Let’s see, could it be our personal tax burden is too low? No, looks like we’re 5th highest in the nation so that’s not it. What about our economy, are we on fire and need some additional taxes to slow it down and get our expansion under control? No, that’s not it either, the Oregon economy is ranked 35th. In case your calculator isn’t working, that means 34 states are in better economic shape than good old Oregon.

We do have the auspicious honor of being the nations 5th highest in unemployment, a number that I’m sure will climb towards that coveted #1 spot as our pubs close and our microbreweries move to other states with the passage of this poorly thought out legislative solution. If you agree this is a bad idea send Oregon Legislators a message through the Oregon Brewer’s Guild at http://oregonbeer.org/no-new-oregon-beer-tax.

Another new Oregon bill was introduced last week. This one, HB 3008 will charge Oregonians $54 every two years for the honor of riding a bike.

Can you smell the desperation? Who comes up with these stupid ideas?

this is the systemic problem that our political system of patronage has created…… politicians want more money for more programs, and they love to shoot themselves in the foot to get it….. problem is they are going to start killing real production in the united states…. at the state as well as federal level….. i can hear the sucking sound, our wealth is being flushed down the drain by ignoramuses

Vermont, whose taxes are high and plentiful, is proposing and increase using Oregon’s bill as a template.

I saw this in a university of Vermont study and had to laugh out loud:

“The Center for Disease Control and Prevention estimates that a $0.20 state tax increase per six-pack of beer could reduce U.S. gonorrhea rates by almost 9 percent.”

I will alert the Foam Rangers in Houston if they don’t know already about this bullsh.

Again they try to cram this down the public. If you take the time to figure out that all of these people are Democrats. Is this a pattern? Wake up, they are going to tax you out of business. So now people will go back to Bud and the other crap because they can’t afford the tax on micro brews. This is a crime against the people of Oregon. Vote these dirtballs out.

If one state gives, in they all will.

I find it immoral to tax citizens so heavily. A priviledge of Roman citizenship in the ancient empire was freedom from taxation…outsiders (those in the colony and precepts), instead, were taxed, as was international trade.

We stand something to learn here.

Irony predicts the revenue would pay for the welfare check of some idle handed moocher who would use the money to by Mickey’s or Boone’s Farm…

Great article. If I lived anywhere near Oregon, I’d have been there.

Insanity. This is like sawing at the branch you’re sitting on. From what I can see, the growth in Orgeon’s craft beer production and sales will take a smack in the eye from this absurdity.

If the tax is too low, then by all means increase it. Just remember aphrase I recall my grandfather using – “Softly, softly. That catches the monkey”. Such a huge hike is bound to send people packing back to cheaper (and sadly, poorer) beers, and we’ll all lose.

Hrm, almost sounds like they were forced to put in a tax hike bill, so they made it as ridiculous as possible so that it would never pass. Maybe this is a blessing in disguise? lol

this is the change that 52+% of the country voted for… feel stupid yet?

it truly is ignorance that binds people to liberal democrats, the same story time after time yet they keep falling foe it this time under the false pretence that the bush admin was responsible for what now we know was greed by a group of financial managers dems and reps… taxes hurt, and a beer tax hurts at the heart of what should be a beneficial part of life…

JOBS and HOPS

I wrote this piece for a writing class. The facts are true and available. Look them up on the US Census Bureau website if you don’t believe me.

HB 2461 itself cites several points for the increase in taxes, many of which seem to be intentionally misleading. HB 2461 states “Whereas alcohol use by Oregon’s eighth graders is 76 percent higher than the national averageâ€, and “Whereas on average, half of the students in every 11th grade classroom in Oregon drinkâ€, but according to the US Census Bureau, 18.43% of Oregon children between the ages of 12 and 17 have consumed alcohol in the past month while the national average is at 16.58%. This number is definitely not 76% higher than the national average, does not constitute a 50% rate of alcohol consumption, and Oregon currently has 13 states ranking higher in this category. Oregon ranks 34th in the nation for percent of people, age 12 and older, who have participated in binge alcohol use. For a state known for brewing beer, one might think the binge rate would be higher. The information offered in HB 2461 has been misinterpreted for the purpose of this bill.

“Whereas raising the malt beverage tax and indexing those taxes to the Consumer Price Index to keep pace with inflation is imperative to protecting Oregon’s citizens†is another point cited by the writers of HB2461. The current Oregon excise tax is about $0.084 per gallon, which ranks Oregon one of the lowest in the US. After the proposed increase, Oregon excise tax will reach slightly over $1.684 per gallon; the highest in the country except for Alaska. Using an inflation calculator provided by the Bureau of Labor Statistics, in accordance with inflation, the new excise tax should be positioned at $.30 per gallon. The writers of HB 2461 need to take a look at their numbers again (US Bureau Of Labor Statistics).

Raising taxes is a natural occurrence, but to such a degree is ridiculous. The proposed increase in taxes will go towards recovering and preventing alcoholism and drug use. According to the US Census Bureau, Oregon ranks the 10th lowest in the nation with an estimated 6.81% of individuals, aged 12 and older who are alcohol dependents or abuse alcohol. According to those who drafted HB 2461, “treatment capacity is so low that less than 25 percent of Oregon adults and only two percent of Oregon youth who need substance abuse services receive the help they needâ€. These stats sound pretty bleak, but there is good news for alcohol abusers. The US Census Bureau states that only 6.60% of individuals in Oregon are “Needing But Not Receiving Treatment for Alcohol Use in Past Yearâ€. So how is there such a drastic discrepancy between this data? Could it be that those who drafted HB 2461 twisted information drastically to promote their tax?

I concede that alcoholism is a problem in this country, and I applaud our collective effort to reduce this issue. Coming from a family that has an exceptionally long standing history of alcoholism, I can say that I understand this issue. I wish that we could help alcoholics and drug addicts, but not in this fashion. Alcohol treatment does not work for most people. A ten year study, reported by the Center on Alcoholism, Substance Abuse, and Addictions (CASAA), states that only 15.2% of alcoholics receiving treatment have abstained from drinking. To compound the issue, “Post hoc investigation showed that 55% of those clients abstinent at 1-year also reporting abstinence at 3-years. Only 19% of clients drinking in year 1 reported abstinence at the 3-year interview†(Maisto, S.). We are stealing money from those who earn it, and giving it to a system that does not work short term or long term.